Audit Preparation Checklist: Your Key to Success

Why Smart Audit Preparation Makes All the Difference

Audits can be stressful, but with proper preparation, they can be managed effectively. Careful planning transforms the audit experience from a dreaded event into a valuable opportunity. Organizations that prioritize audit preparation often experience shorter audits, fewer follow-up requests, and ultimately, better results. This preparedness offers significant benefits, saving valuable time and resources. It also demonstrates professionalism and builds credibility with auditors and stakeholders.

Understanding Your Audit Type

The first step in effective audit preparation is understanding the specific type of audit your organization will undergo. Is it a financial audit, focusing on the accuracy of your financial statements? Will it be a compliance audit, assessing adherence to specific regulations? Or perhaps it's an operational audit, evaluating the efficiency and effectiveness of your internal processes. Each type requires a distinct approach to your audit preparation checklist. For instance, a financial audit requires meticulous documentation of financial transactions, while a compliance audit requires proof of adherence to specific legal requirements.

The Power of Proactive Preparation

Audit preparation is increasingly important in today's business world. The shift toward digital tools is changing how audits are conducted. According to a 2021 finance and audit technology survey by KPMG and Forbes Insights, most finance executives consider technologies like cloud computing, AI, and smart analytics essential for audits. 66% anticipate significant changes to auditing processes by 2026. Explore this topic further. Integrating technology into audit preparation checklists enhances efficiency and helps ensure compliance. Digital checklists, for example, standardize procedures, reduce errors, and enable real-time collaboration among audit teams.

Building Credibility and Confidence

Thorough audit preparation demonstrates a commitment to transparency and accountability. This proactive approach builds trust with auditors, creating a more collaborative environment. When you can easily provide necessary documentation and confidently answer questions, it indicates a strong control environment and a dedication to best practices. This not only simplifies the audit process but also strengthens your organization's reputation with stakeholders. By viewing preparation as a strategic advantage, you position your organization for audit success and demonstrate a commitment to ongoing improvement.

Building Your Bulletproof Audit Preparation Checklist

An audit can be daunting, but thorough preparation can make all the difference. A well-crafted audit preparation checklist transforms a potentially stressful event into a manageable, even beneficial, process. It acts as your roadmap, guiding you through each step to ensure a smooth and successful audit.

Essential Components of Your Checklist

A truly effective audit preparation checklist is comprehensive. Think of it like constructing a building: a strong foundation is crucial. Just as blueprints are essential for builders, a detailed plan is vital for audit preparation. This plan should include several key aspects:

-

Document Organization: Finding a document in a messy room is far more difficult than retrieving it from a well-organized filing cabinet. Quick access to essential files is crucial during an audit. Implement a system, whether digital document management software like M-Files or a meticulous physical filing system, to facilitate efficient retrieval.

-

Clear Responsibility Assignments: Every team member needs to understand their roles and responsibilities. This prevents tasks from being overlooked and promotes accountability. Clear delegation, much like a conductor leading an orchestra, ensures everyone contributes effectively.

-

Internal Control Assessments: Before the external auditors arrive, conduct a thorough internal review of your controls. This proactive approach helps identify and address any potential weaknesses, demonstrating your commitment to strong internal processes.

-

Realistic Timelines: Create a preparation timeline that considers your team's existing workload. An unrealistic schedule leads to rushed work and potentially overlooked details. Like a marathon runner pacing themselves, a sensible timeline ensures a steady and successful preparation process.

Preparing for an audit necessitates a comprehensive checklist to ensure readiness and compliance. Understanding the audit's scope is key. For instance, a compliance audit might focus on IT infrastructure or financial operations. A typical checklist includes reviewing current compliance, allocating resources, implementing necessary changes, gathering supporting evidence, and collaborating with the auditor. Learn more about audit preparation here. Another helpful resource is available here: How to master your compliance audit checklist.

Adapting to Different Industries

While the core elements remain constant, the specific details of your checklist should be tailored to your industry and operational structure. A healthcare organization, for example, faces different regulatory requirements than a manufacturing company. Your checklist should be a custom fit, reflecting the unique needs of your specific environment.

Structuring Your Checklist

For clarity and usability, structure your checklist logically. The following table offers a helpful template:

To ensure a comprehensive and effective approach, consider the essential components outlined in the table below:

Core Elements of an Effective Audit Preparation Checklist: This table outlines the essential components that should be included in any comprehensive audit preparation checklist, organized by category and importance.

| Checklist Component | Purpose | Critical Timeframe | Responsible Party | |---|---|---|---| | Gather Financial Statements | Provide financial data to auditors | 2 weeks before audit | Finance Department | | Review Internal Controls | Identify potential weaknesses | 1 month before audit | Compliance Officer | | Organize Supporting Documents | Ensure easy access to information | Ongoing | Assigned Team Members | | Secure IT Infrastructure | Protect sensitive data | Ongoing | IT Department | | Review Relevant Policies | Ensure compliance with regulations | 1 month before audit | Legal Department | | Communication Plan | Facilitate clear communication with auditors | 2 weeks before audit | Audit Liaison |

Key Insights: This checklist provides a framework for organizing and prioritizing audit preparation tasks. The designated timeframe and responsible party contribute to a smooth and efficient audit process.

By following these steps and building a robust checklist, you can approach your audit with confidence, ensuring a more positive and productive experience. A bulletproof audit preparation checklist isn’t just a compliance tool; it’s a strategic asset that strengthens your organization and contributes to long-term success.

Customizing Your Checklist For Different Audit Types

No two audits are the same, which means your audit preparation checklist needs to be flexible. This section explores how to adapt your checklist for various audit types, including financial, compliance, operational, and IT audits. Each type has its own set of documentation requirements and auditor expectations.

Identifying Relevant Regulations and Standards

The first step in customizing your checklist is identifying the relevant regulations and standards for your specific industry and audit type. For instance, a financial audit for a publicly traded company in the US must comply with the Sarbanes-Oxley Act (SOX). However, a non-profit organization may have different reporting standards. Consider referencing an existing checklist, like an ISO 9001 audit checklist, to ensure comprehensive coverage of all necessary compliance areas.

Preparing Stakeholders for Different Audit Contexts

Different stakeholders have varying roles depending on the audit. In a financial audit, the CFO and the finance team are key players. For a compliance audit, the legal department and compliance officer become more central. Your checklist should include preparing these stakeholders based on their individual roles and responsibilities. This might include training on audit procedures or gathering specific documentation relevant to their area.

Tailoring Response Strategies to Audit Focus and Methodology

Each audit type also has a unique focus and methodology. A financial audit concentrates on financial statements, while an operational audit analyzes internal processes. Your response strategies should be tailored accordingly. For example, preparing detailed reconciliations might be necessary for a financial audit, whereas an operational audit could focus on process documentation and improvement plans.

To understand the preparation requirements better, let's look at a comparison table summarizing the key aspects of each audit type.

Comparison of Preparation Requirements Across Audit Types | Audit Type | Key Documentation | Primary Stakeholders | Unique Preparation Needs | Common Pitfalls | |---|---|---|---|---| | Financial Audit | Financial statements, bank reconciliations, general ledger | CFO, Finance team, external auditors | Detailed financial analysis, reconciliation of accounts, review of internal controls over financial reporting | Inaccurate or incomplete financial records, inadequate documentation of internal controls | | Compliance Audit | Policy documents, training records, incident reports | Compliance Officer, Legal team, internal auditors | Thorough understanding of relevant regulations, evidence of compliance activities, remediation of identified gaps | Lack of documented policies and procedures, insufficient training records, ineffective monitoring of compliance activities | | Operational Audit | Process documentation, performance metrics, risk assessments | Operational managers, internal auditors | Analysis of process efficiency and effectiveness, identification of areas for improvement, development of action plans | Lack of clear process documentation, insufficient performance data, resistance to change from operational teams | | IT Audit | System access logs, security policies, change management documentation | IT Manager, Security team, internal or external IT auditors | Evaluation of IT system security, review of access controls and data integrity, assessment of IT risks | Inadequate security controls, outdated IT systems, lack of disaster recovery plan |

This table highlights the distinct documentation, stakeholder involvement, and preparation needs for each audit type, enabling a more focused and effective approach.

Control Effectiveness: A Key Consideration

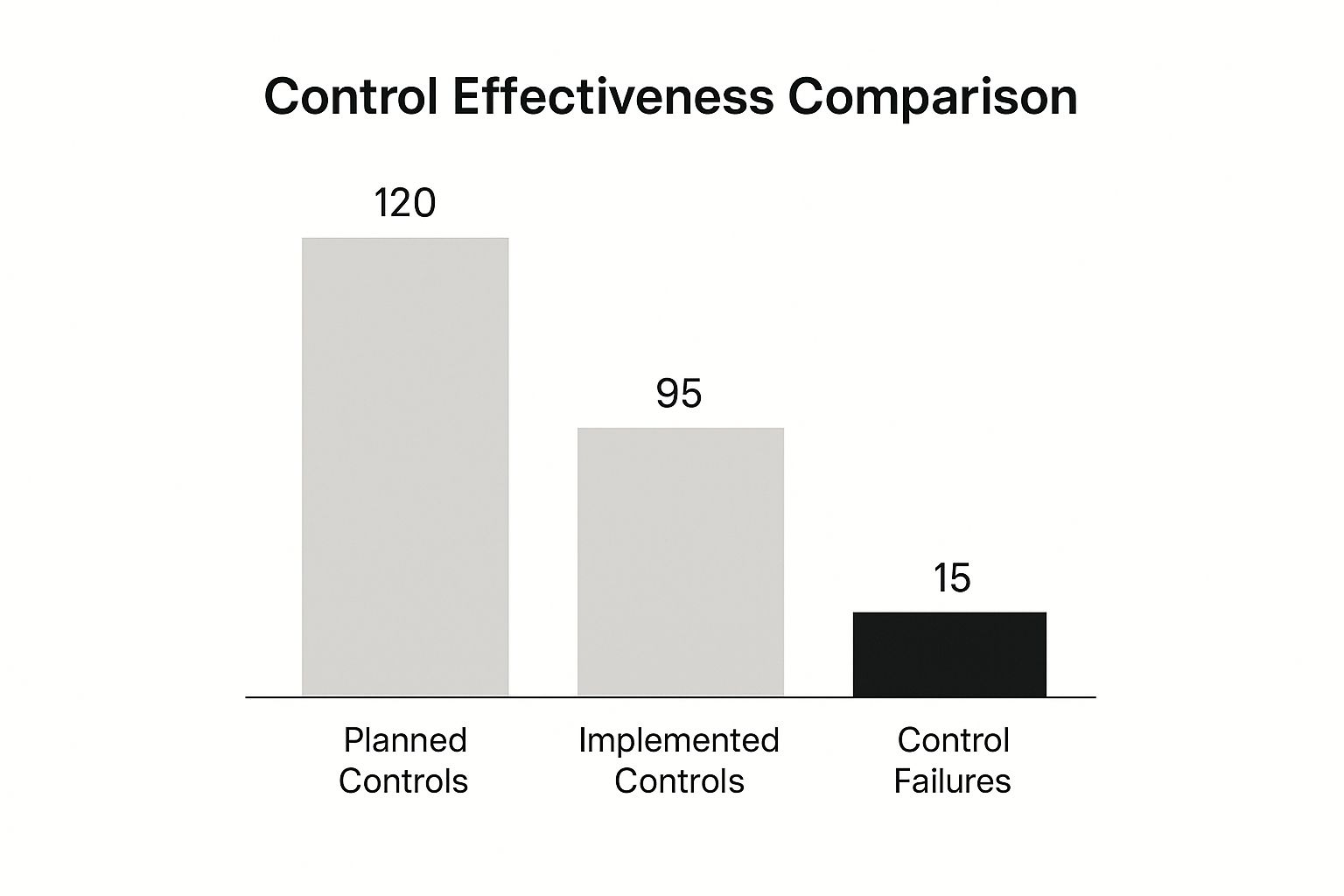

Assessing the effectiveness of internal controls is a critical part of audit preparation. This proactive approach to risk management helps identify and correct weaknesses before the auditors arrive. The following infographic visualizes the relationship between planned controls, implemented controls, and resulting control failures.

The infographic shows that while 120 controls were planned and 95 were implemented, 15 still failed. This emphasizes the importance of not only implementing controls, but also ensuring their ongoing effectiveness through regular monitoring and testing. Addressing control failures proactively strengthens your organization's overall audit readiness.

Customizing Your Checklist: A Summary

By understanding the specific requirements of different audit types, you can customize your audit preparation checklist to ensure a smooth and successful audit process. This tailored approach not only simplifies the audit but also enhances your organization's compliance posture and builds stronger relationships with auditors. A well-prepared organization is a confident organization.

Conducting Powerful Pre-Audit Self-Assessments

The most successful organizations know that effective audit preparation starts well before the auditors walk in the door. These organizations proactively identify and fix potential issues through strong self-assessment programs. This not only makes the audit process smoother but also shows a commitment to strong internal controls and continuous improvement. Having a thorough audit preparation checklist is essential.

Methodologies for Effective Self-Assessment

There are several practical ways to perform effective pre-audit self-assessments. Internal reviews, done by people within the organization but outside the area being audited, provide an unbiased viewpoint. Targeted mock audits simulate the real audit process, letting teams practice their responses and find areas for improvement. Gap analyses systematically compare current practices against regulatory requirements or best practices, highlighting any shortcomings. Each of these methods provides valuable insights to boost your audit preparedness.

Building Your Self-Assessment Team

The success of your self-assessment depends heavily on the team you put together. This team should have the right mix of skills and, importantly, objectivity. Including people from different departments provides diverse perspectives and expertise.

For example, an IT specialist can be helpful for a financial audit to assess the security of financial systems. Similarly, someone from the finance team can offer insights during an operational audit focusing on resource allocation. To maintain objectivity, however, the team shouldn’t include anyone directly responsible for the area being assessed.

Developing Assessment Templates and Remediation Plans

Develop assessment templates that focus on high-risk areas specific to your industry and the type of audit you're facing. These templates should act as guides, ensuring consistent and thorough evaluations.

Once you find potential issues, create remediation plans that prioritize efforts based on the potential impact of the issue and how feasible a solution is. Just like a doctor prioritizes treating the most serious conditions first, your remediation plan should address the most critical gaps immediately.

Real-World Examples and Transforming Potential Audit Findings

Many organizations have successfully turned potential audit findings into demonstrations of proactive management through strategic self-assessment. One manufacturing company, for example, found a weakness in its inventory management system during a self-assessment. By addressing this before the external audit, they not only avoided a negative finding but also improved operational efficiency.

Another organization, a non-profit, discovered gaps in its grant compliance procedures. Their proactive remediation efforts strengthened their internal controls and built more trust with funders. These examples show how powerful self-assessment can be to improve both audit readiness and overall organizational effectiveness. By proactively identifying and addressing these issues, you build a strong foundation for a smoother audit and demonstrate a commitment to continuous improvement. Remember, the goal isn’t just to pass the audit; it’s to constantly improve your processes and strengthen your organization. Through a detailed audit preparation checklist and proactive self-assessments, you transform audit preparation from a chore into a driver of growth and greater efficiency.

Leveraging Technology To Transform Your Audit Readiness

Modern audit preparation increasingly depends on digital tools to boost efficiency and accuracy. Smart organizations are using technology to overhaul their audit process, incorporating specialized audit management platforms, document organization systems, and data analytics tools. These solutions automate tedious tasks and improve oversight, resulting in a more effective audit preparation checklist.

Streamlining Document Access and Communication

One of the key benefits of using technology in audit preparation is improved document accessibility. Cloud-based document management systems like Egnyte create a central hub for all audit-related files, allowing auditors and internal teams to quickly access necessary information. This eliminates sifting through physical files or long email chains. This streamlined access saves time and reduces the risk of misplacing important documents. For tips on improving organization, check out this helpful resource: How to master staying organized. Plus, these platforms often include version control, ensuring everyone uses the most up-to-date documents, further minimizing errors and inconsistencies.

Technology also streamlines communication between audit teams. Integrated communication features within audit management platforms enable real-time collaboration and information sharing, replacing lengthy email exchanges or in-person meetings. This creates a more collaborative environment and allows for quicker resolution of questions or issues that pop up during the audit process. This immediate feedback contributes to a more efficient and less disruptive audit experience.

Enhanced Visibility and Real-Time Progress Tracking

Technology provides real-time visibility into audit preparation progress. Audit management platforms offer dashboards and reporting tools that track key metrics, such as document completion status, outstanding requests, and overall progress against the audit preparation checklist. This transparency allows management to closely monitor the preparation process, identify potential roadblocks, and proactively address any delays. This empowers organizations to approach audits with more confidence, knowing they have a clear picture of their preparedness.

Evaluating and Implementing Audit Technology Solutions

Choosing the right technology solution is essential for maximizing your return on investment. Organizations should consider several factors when evaluating potential solutions:

- Implementation Considerations: How easily can the new technology integrate with existing systems?

- Training Requirements: What level of training will staff require to effectively use the new tools?

- ROI Calculation: What are the projected cost savings and efficiency gains from adopting the technology?

By carefully weighing these factors, businesses can select the technology that best fits their needs and budget. Strategically implementing technology not only improves audit readiness but also enhances the overall efficiency and effectiveness of internal control processes. This ultimately strengthens the overall control environment and sets the organization up for long-term success.

Transforming Auditor Relationships From Adversarial to Allied

The relationship with your auditor significantly impacts the audit experience. Instead of viewing the auditor as an adversary, cultivating a collaborative partnership can make the process smoother and more productive. This shift requires a proactive approach to communication and transparency.

Setting Clear Expectations and Establishing Effective Communication

Open communication is critical for a successful audit. From the initial planning stages, establish clear expectations with your auditor. Discuss the scope of the audit, timelines, and key points of contact.

This upfront clarity minimizes potential misunderstandings and ensures everyone is aligned. Also, establish regular communication channels, such as weekly check-ins or progress reports. This keeps the auditor informed and provides a forum to address questions promptly. For optimizing your technology practices, consider these insights into CI/CD pipeline best practices.

Creating a Cooperative Environment

The audit environment should be one of professional cooperation, not conflict. Provide the auditor with a dedicated workspace and access to necessary resources, including relevant documentation and personnel. This shows respect for their role and enables efficient information gathering.

Being responsive to auditor requests also strengthens the relationship. Aim to provide information completely and quickly. This responsiveness demonstrates transparency and builds trust. A comprehensive audit preparation checklist can be very helpful in this regard.

Navigating Disagreements Constructively

Even in the best circumstances, disagreements can occur during an audit. The key is to address these issues constructively. Listen to the auditor's concerns and explain your perspective clearly and respectfully.

A collaborative approach focuses on finding solutions, not assigning blame. If a resolution can't be reached immediately, agree on a process for escalating the issue. This might involve bringing in senior management or seeking external counsel.

Reaping the Benefits of Positive Auditor Relationships

Organizations with positive auditor relationships often report more valuable audit insights and smoother experiences. This collaborative approach fosters open dialogue, leading to a deeper understanding of the organization’s strengths and weaknesses.

Auditors can offer valuable feedback on internal controls and suggest improvements that go beyond simple compliance. A positive relationship also reduces stress and anxiety associated with audits, creating a more productive experience for everyone. By using these strategies, organizations can transform the audit process from a burden to a valuable opportunity for growth. This, in turn, strengthens the organization's control environment and supports long-term success.

Turning Audit Results Into Strategic Improvements

The most effective organizations don't just endure audits. They use them as opportunities to improve and grow. They understand that audit findings aren't just a list of problems, but valuable insights that can drive positive change. This proactive approach transforms the audit process from a necessary task into a catalyst for real progress.

Interpreting Audit Results Systematically

Understanding what audit findings mean is key to fixing any issues. Start by categorizing findings based on their severity and potential impact. High-risk findings, such as serious weaknesses in internal controls, demand immediate attention. Moderate-risk findings, like minor documentation gaps or policy deviations, need prompt action, but are often less urgent. Low-risk observations can typically be addressed through simple process tweaks or staff training. This systematic approach allows you to focus resources where they're needed most.

Prioritizing Remediation Efforts: Risk and Operational Impact

When you're creating a post-audit action plan, prioritization is essential. Consider both the likelihood and potential impact of each finding. For example, a weakness in IT security controls might be unlikely to be exploited, but could have devastating consequences if it were. On the other hand, a small procedural error in data entry might happen often, but have little financial impact. Balancing risk and impact allows you to allocate resources effectively.

Implementing Sustainable Improvements: Preventing Recurring Issues

Real improvement isn't just about fixing current problems; it's about preventing them from happening again. This means implementing sustainable solutions that become part of your regular operations. For instance, if the audit revealed insufficient documentation, a new document management system addresses the root cause, rather than just updating the missing files. This proactive approach, much like adhering to best practices for building quality code, builds a stronger, more resilient organization.

Developing Action Plans: Accountability, Timelines, and Measurable Outcomes

A solid action plan is the foundation of post-audit improvement. Each finding should have a corresponding plan outlining specific steps, assigning clear responsibilities, and setting realistic deadlines. Crucially, these plans must include measurable outcomes so you can track progress and show the effectiveness of your work. For example, if the audit identified a need for better staff training, the action plan should specify the training program, who it's for, completion dates, and how you’ll measure its effectiveness.

Integrating Audit Learnings: Continuous Improvement Through Your Audit Preparation Checklist

Leading organizations integrate audit learnings into their daily work and, importantly, their audit preparation checklists. This creates a continuous improvement cycle where each audit informs and improves the next. By updating your checklist with lessons learned, you avoid repeating past mistakes and constantly raise your standards for audit readiness. This proactive approach fosters a culture of compliance and operational excellence that goes far beyond simply passing audits.

Ready to streamline your code review process and boost your audit preparation? Pull Checklist helps automate and streamline your workflow, ensuring consistency and reducing errors. Explore the benefits of Pull Checklist today!